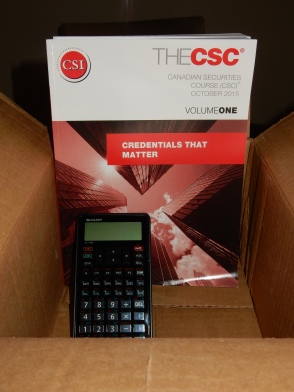

I can’t do math (specifically algebra). Have I told you that lately? As sure as I am that I have blue eyes, I know I can’t do math. So I was understandably stressed while preparing to take the first exam for the Canadian Securities Course. Even one of the easier formulas like this:

Made my brain look like that:

But I can do words and study and memory. I decided to tackle the formulas a different way. Instead of the mathematical shorthand seen above, I broke it down into words I could study and memorize:

Yield to maturity equals interest income plus or minus price change, divided by, face value plus price divided by two.

Once I wrote it out enough times I could add a little shorthand of my own:

YTM = interest income +/- price change, divided by, FV + price divided by 2.

I was getting somewhere.

But still – if there were too many math questions I was in for a hard time. Seven months and it came down to this. I needed at least 60% to pass and while many people were cheering me on, I never take anything for granted and my concern was real (there is nothing false about my modesty). I was just going to have to suck it up and ride the fall. I went into the exam prepared to be brave enough to fail.

The time came, the proctor handed me the exam booklet and I took a look. There, of the 100 questions, only 10 even had numbers in them. I only used one formula I had memorized and there was one calculation I could do IN MY HEAD.

Results were swift – three days later I emitted an “Eep!” when I checked online and found I had passed. I didn’t ace it but I didn’t squeak by either. I did something that scared me, did it successfully and lived to tell the tale. If there’s hope for me, there’s hope for just about anyone.

Halfway there.